Understanding Sequence of Returns Risk

A critical risk factor that can make or break your retirement portfolio, regardless of average returns

What is Sequence of Returns Risk

It is the danger that poor market performance early in retirement severely depletes your portfolio.

The order of investment returns is critical when you are making withdrawals.

A market downturn early in retirement has a greater impact than a later one.

Early poor returns can create a deficit that is difficult to overcome.

This risk primarily applies once you’ve retired and are generating income from your portfolio. Early poor returns create a deficit that compounds with each withdrawal as losses get locked in.

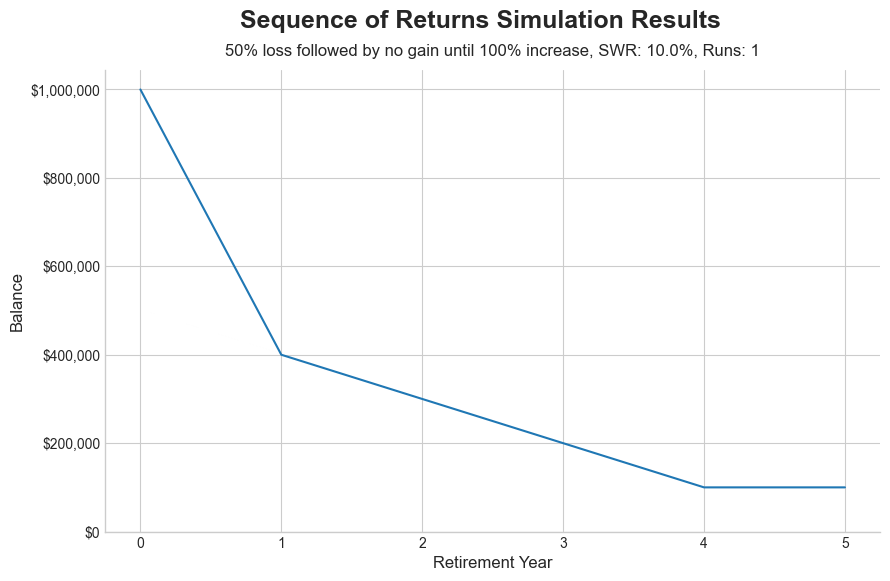

Example - Initial Loss

Starting Scenario

Initial Balance: $1,000,000

Annual Withdrawal: $100,000

Simulated Market Returns

Year 1: -50% loss

Years 2–4: 0% change

Final Year: +100% gain

Critical Insight: A significant early market loss, combined with ongoing withdrawals, severely depleted the portfolio. The early withdrawals meant less capital remained to benefit from the final year’s 100% recovery, resulting in a much lower final balance than the returns alone would suggest. I.E. withdrawals “locked in” the losses.

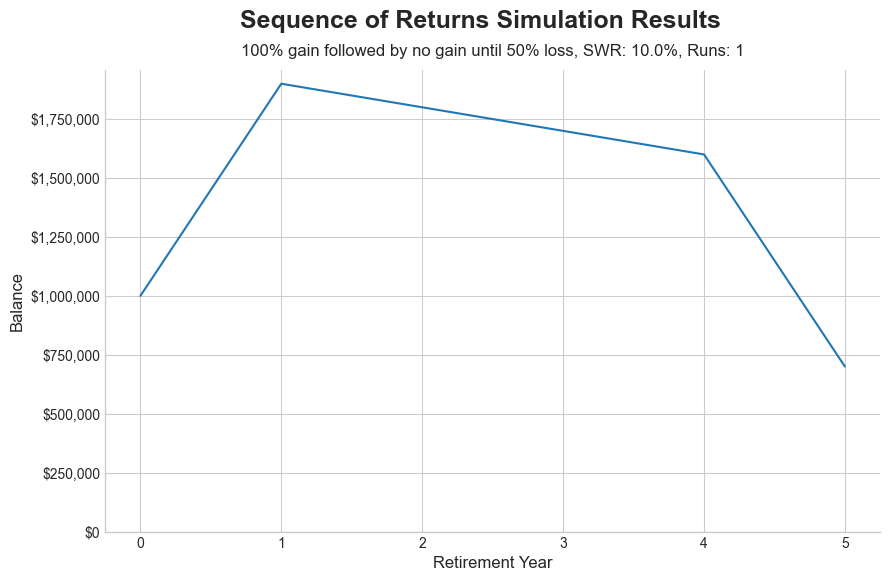

Example - Initial Gain

Starting Scenario

Initial Balance: $1,000,000

Annual Withdrawal: $100,000

Simulated Market Returns

Year 1: +100% gain

Years 2–4: 0% change

Final Year: -50% loss

Critical Insight: The opposite is true with high gains. With no net return, and annual withdrawals of $100K, you would expect a balance of $500K. But the account has a higher balance as the withdrawals were at an inflated account balance.

A buy and hold investor would have exited either scenario with the balance unchanged at $1M.

Key Takeaways

Timing matters

The order in which your investment returns occur is as critical as the average return, particularly when withdrawing funds for income.

Volatility and Withdrawals

High-volatility, high-return investments may leave your portfolio poorer than lower-return investments if you are drawing down the principal for income.

Mitigation

Diversified portfolios (including stocks, bonds, gold, etc.) can be used to reduce volatility and, consequently, mitigate Sequence of Returns Risk.

A successful retirement has an element of luck, as the sequence of returns, not just the average, significantly affects your final account balance.

You may not time the market, but it may time you.

Ready to learn more?

Dive deeper into investing, saving, and withdrawal strategies through our comprehensive Learning Track.

Prefer updates in your inbox? Subscribe below to get all our content delivered straight to you via email.

We love hearing from our readers. If you have questions about this post, or want to suggest a topic for a future article, please use the Chat link on our Substack home page to reach out.

Disclaimer

**For Educational Purposes Only:** All content on this site, including articles, tools, and simulations, is for informational and educational purposes only. It should not be construed as financial, investment, legal, or tax advice. The information provided is general in nature and not tailored to any individual’s specific circumstances.

**Software Development Has Inherent Risks:** The software used to perform the analyses may have errors or inaccuracies. When we post updates to any material, errors or inaccuracies that are subsequently fixed may change the results.

**No Guarantees & Risk of Loss:** The analyses and simulations presented are based on historical data. Past performance is not an indicator or guarantee of future results. All investing involves risk, including the possible loss of principal. Market conditions are subject to change, and the future may not resemble the past.

**No Fiduciary Relationship:** Your use of this information does not create a fiduciary or professional advisory relationship. We are not acting as your financial advisor.

**Consult a Professional:** You should always conduct your own research and due diligence. Before making any financial decisions, it is essential to consult with a qualified and licensed financial professional who can assess your individual situation and objectives. We disclaim any liability for actions taken or not taken based on the content of this site.

* Nobody associated with Algorithmic Fire LLC has any credential(s) or affiliation(s) with any licensing or regulatory bodies, including but not limited to: Securities and Exchange Commission (SEC), Financial Industry Regulatory Authority (FINRA).

© 2025 Algorithmic Fire LLC. All rights reserved.